One unlucky facet of the world of Miles & Factors is that loyalty program devaluations are sure to happen.

Typically, we’re a minimum of given the courtesy of advance warning, however all too typically, you get up one morning solely to seek out that your factors are much less helpful or much less versatile than they had been went you went to sleep.

When you can by no means absolutely shield your self and your factors, there are some steps you possibly can take to a minimum of mitigate the possibilities that you simply’ll get stung by loyalty program devaluations.

Loyalty Program Devaluations Are By no means Nice

Loyalty program devaluations are as inevitable as they’re unpredictable (and unlucky). As members, we’re on the mercy of no matter packages determine to do, and there’s not a lot we will do to keep away from them outright.

Within the final couple of years alone, there have been quite a few important loyalty program devaluations that turned as soon as compelling packages and candy spots into issues to keep away from altogether.

Among the extra distinguished ones that come to thoughts embrace:

Devaluations additionally rear their ugly heads in lots of varieties, together with (however not restricted to) the next:

- Growing the variety of factors required for a selected flight/resort keep

- Growing the quantity of taxes and charges required for a selected itinerary (whereas the fee in factors stays the identical)

- Growing the thresholds for attaining elite standing (or weakening the advantages provided at numerous tiers)

- Eradicating a switch associate (due to this fact making your factors much less versatile)

Whereas loyalty packages often attempt to spin the devaluations as enhancements or offering higher worth to members, the alternative is sort of at all times the case.

When Lufthansa lately introduced “thrilling modifications” coming to its Miles & Extra program, it portrayed a shift from fastened pricing to dynamic pricing as wholly optimistic. Nevertheless, the fee for a lot of awards is growing – generally considerably – and the worth of your miles in this system is lowering.

One in every of my favorite devaluation bulletins got here from Cathay Pacific Asia Miles, which printed a reference to devaluing this system in an FAQ on its web site, solely to dodge its personal query altogether and take away it a number of hours later.

Some airways supply an announcement and detailed breakdown of modifications upfront of them taking impact, which a minimum of gives members the possibility to redeem factors on the present ranges earlier than they modify. This looks as if the minimal courtesy a program might supply its members.

In any other case, program devaluations are made quietly, and members of the Miles & Factors neighborhood are left to their very own units to piece all the pieces collectively. Informal fans won’t even understand that their factors have been devalued.

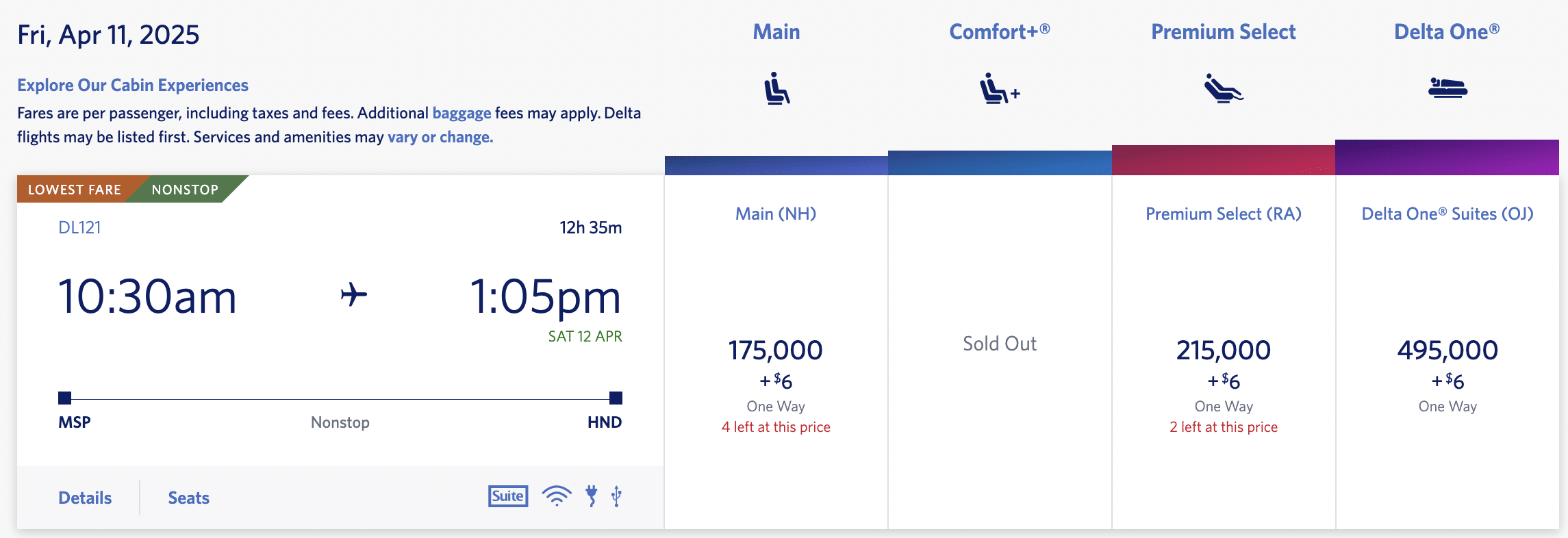

Moreover, with many packages transferring away from fastened prices and venturing in direction of dynamic pricing, devaluations have gotten tougher to detect.

A standard apply as of late is for packages to listing “beginning at” costs for redemptions. When you could discover flights at these ranges – sometimes called “Saver” awards – the sky’s the restrict for something above that.

Lastly, in Canada, some devaluations hit tougher than others, in that we’re typically topic to sub-par switch ratios to packages.

For instance, in case your main entry level to Air France KLM Flying Blue is thru American Categorical Membership Rewards, then you definately’re topic to a switch ratio of 1:0.75 (1,000 Membership Rewards factors = 750 Flying Blue miles).

Earlier this 12 months, Flying Blue raised the minimal worth for transatlantic enterprise class redemptions from 50,000 miles to 60,000 miles. On paper, that’s a rise of 10,000 miles, however with the switch ratio considered, it’s really moved from 66,667 MR factors to 80,000 MR factors.

At that worth, you’re significantly better off reserving transatlantic flight rewards by means of Aeroplan (availability allowing), because you’ll pay 60,000–70,000 factors (assuming you e-book with a associate airline akin to Swiss or Turkish Airways). Plus, Membership Rewards factors switch to Aeroplan at a 1:1 ratio.

Tips on how to Defend Your Factors from Devaluations

With the above in thoughts, let’s discover a few of the methods you possibly can shield your factors from devaluations, which recognizing that you simply’re sure to come across one (or extra) throughout your Miles & Factors journey.

Hold Transferable Factors Transferable

The perfect factors to earn are transferable factors, which provide the best flexibility for redemptions.

In Canada, one of the best factors to earn for journey are American Categorical Membership Rewards (which switch to 6 airline companions and two resort companions) and RBC Avion factors (which switch to 4 airline companions).

When planning out a redemption, your finest wager is to preserve your transferable factors in your account till you’ve discovered a flight or resort keep that you simply’d prefer to e-book. Then, switch them out, and e-book instantly to safe it at its present worth (or leverage an award maintain till your factors arrive).

In the event you had been to speculatively switch your transferable factors into your loyalty program of selection, ought to that program devalue unexpectedly, your whole factors eggs are in a single factors basket, and you could possibly be out of luck.

Credit score Playing cards with Transferable Factors

| Credit score Card | Greatest Supply | Worth | |

|---|---|---|---|

|

130,000 MR factors $799 annual price |

130,000 MR factors | $1,794 |

Apply Now |

|

70,000 MR factors $250 annual price |

70,000 MR factors | $1,676 |

Apply Now |

|

100,000 MR factors $799 annual price |

100,000 MR factors | $1,141 |

Apply Now |

|

55,000 RBC Avion factors† $120 annual price |

55,000 RBC Avion factors† | $1,080 |

Apply Now |

|

55,000 RBC Avion factors† $120 annual price |

55,000 RBC Avion factors† | $1,080 |

Apply Now |

|

40,000 MR factors $199 annual price |

40,000 MR factors | $846 |

Apply Now |

|

As much as 70,000 RBC Avion factors† $399 annual price |

As much as 70,000 RBC Avion factors† | $801 |

Apply Now |

|

35,000 RBC Avion factors $175 annual price |

35,000 RBC Avion factors | $700 |

Apply Now |

|

35,000 RBC Avion factors $120 annual price |

35,000 RBC Avion factors | $580 |

Apply Now |

|

15,000 MR factors $156 annual price |

15,000 MR factors | $372 |

Apply Now |

Earn & Burn (with Function)

In the event you’ve been across the Miles & Factors world for a minute, you’ve probably heard individuals recommending that you simply earn and burn as typically as potential.

Sadly, factors are a horrible funding, they usually don’t have a tendency to understand over time. In the event you maintain out on a redemption for too lengthy, there’s an excellent probability that you simply’ll must pay far more than you’ll have should you booked a lot sooner.

Whereas incomes factors throughout a number of packages definitely provides you extra choices, I’d advocate that you simply set a transparent objective, concentrate on the factors packages that may enable you to meet that objective, after which e-book it as quickly as you attain it.

For instance, my entry into Miles & Factors got here with eager to fly in enterprise class for our honeymoon (manner again in 2018).

We set our objective of flying with Turkish Airways utilizing Aeroplan factors, after which labored backwards from there by paying for as a lot of our marriage ceremony as potential with bank cards that earned Aeroplan factors and American Categorical Membership Rewards factors.

It didn’t take lengthy to earn sufficient factors to e-book our flights, at which level we set a brand new objective of incomes resort factors for some aspirational stays alongside the way in which, and continued onward from there.

Having a transparent objective in place will enable you to create a plan on the way to get there, and you may be intentional together with your factors technique.

Data Is Energy

Oftentimes, the identical flight might be booked with a number of packages, which implies that even when the flight you’ve had your eyes on is devalued in a single program, it’s probably nonetheless out there for much less by means of one other.

Let’s use a hypothetical state of affairs as an instance this.

British Airways flights might be booked with a wide range of loyalty packages, together with (however not restricted to) British Airways Government Membership, Cathay Pacific Asia Miles, American Airways AAdvantage, Finnair Plus, and Qatar Airways Privilege Membership.

All of those packages are accessible by means of transferable factors packages and/or co-branded bank cards in Canada (or by changing factors from throughout the Avios ecosystem).

If the fee had been to extend in a single program, then your first wager ought to be to have a look at the fee out there by means of different packages, after which switch your factors accordingly. (That is one other reminder to maintain your transferable factors versatile for so long as potential).

The truth is, that is precisely what occurred final 12 months when American Airways and Alaska Airways flights had been devalued from British Airways Government Membership, however they had been nonetheless bookable by means of Qatar Airways Privilege Membership on the previous costs (a minimum of quickly).

By merely changing your British Airways Avios into Qatar Airways Avios (immediately and without charge), you could possibly e-book the identical flights on the pre-devaluation costs.

Ebook Now (and Suppose Later)

Lastly, should you’re in a position to be versatile together with your journey plans, it’s worthwhile to think about pouncing on alternatives as they arrive up after which planning a visit round it afterwards.

In spite of everything, you’re solely ever assured the worth at which you’ll be able to e-book one thing immediately – it might rise tomorrow, and then you definately’re out of luck.

In the event you’ve had your eyes set on a specific redemption and it turns into out there both by means of an sudden award drop or at saver-level pricing, think about reserving it instantly and constructing a visit round it later.

In case your plans change, it is best to have the ability to cancel your reserving without spending a dime or at an affordable value, which is one thing you could’t typically do with money bookings for a similar issues.

For instance, one of the crucial helpful makes use of of Marriott Bonvoy factors was to make a five-night award reserving on the JW Marriott Masai Mara Lodge in Kenya.

Whereas Marriott Bonvoy has used dynamic pricing for fairly a while, the fee in factors has been much more engaging than the fee in money, and there was loads of alternative to attain outsized worth.

Not way back, you could possibly e-book a keep for as few as 75,000 factors per evening (rising to about 120,000 factors per evening). These costs had been very engaging on condition that money costs hover at $1,750 (USD) per evening or extra.

After the newest devaluation, through which Marriott Bonvoy seemingly raised the ceiling on award costs, the bottom worth you’ll see within the subsequent 12 months is 196,000 factors per evening, although it typically prices 200,000 factors per evening or extra.

I’m personally kicking myself for not profiting from a keep once I had the possibility, since now I’m going to must fork over far more factors than I’d prefer to for a similar expertise.

After all, this begs the query of whether or not you’re doing one thing since you wish to or simply as a result of you possibly can, which is a subject for one more article.

Conclusion

It’s unimaginable to keep away from loyalty program devaluations, since we’re left on the mercy of no matter modifications (good or (extra typically) unhealthy) the packages determine to make, with or with out discover.

As irritating as it’s, there are some methods in which you’ll be able to shield your hard-earned factors from devaluations, which we’ve explored on this information.

With increasingly packages transferring to dynamic pricing, I’d encourage everybody to earn and burn as typically as potential to make sure you will get one of the best worth out of your factors.