Incomes factors and miles is the easiest way to fly extra for much less. It’s the best way I’ve been in a position to keep on the street for thus lengthy — and I’ve seen what a distinction it’s made for my readers too.

I write loads concerning the greatest bank cards to get relying in your journey objectives, however I’ve talked much less about how to make use of these factors.

At the moment, I need to change that as a result of I preserve getting emails from individuals speaking about the way it takes too many factors to guide a flight. After I observe up, it’s as a result of they’re reserving by means of the bank card’s journey portal and that’s one thing it’s best to hardly ever, if ever, do!

Journey rewards playing cards provide two principal methods to make use of the factors that you simply earn to guide journeys:

- By transferring factors to their journey companions

- By utilizing a card issuer’s reserving portal

For many who are new to incomes and utilizing factors and miles, there’s a number of confusion about which is the higher possibility. Journey bank cards place their portals as the best choice for utilizing your factors. However, in actuality, they hardly ever ever are.

So let’s speak about why that is.

The Low-Down on Journey Portals

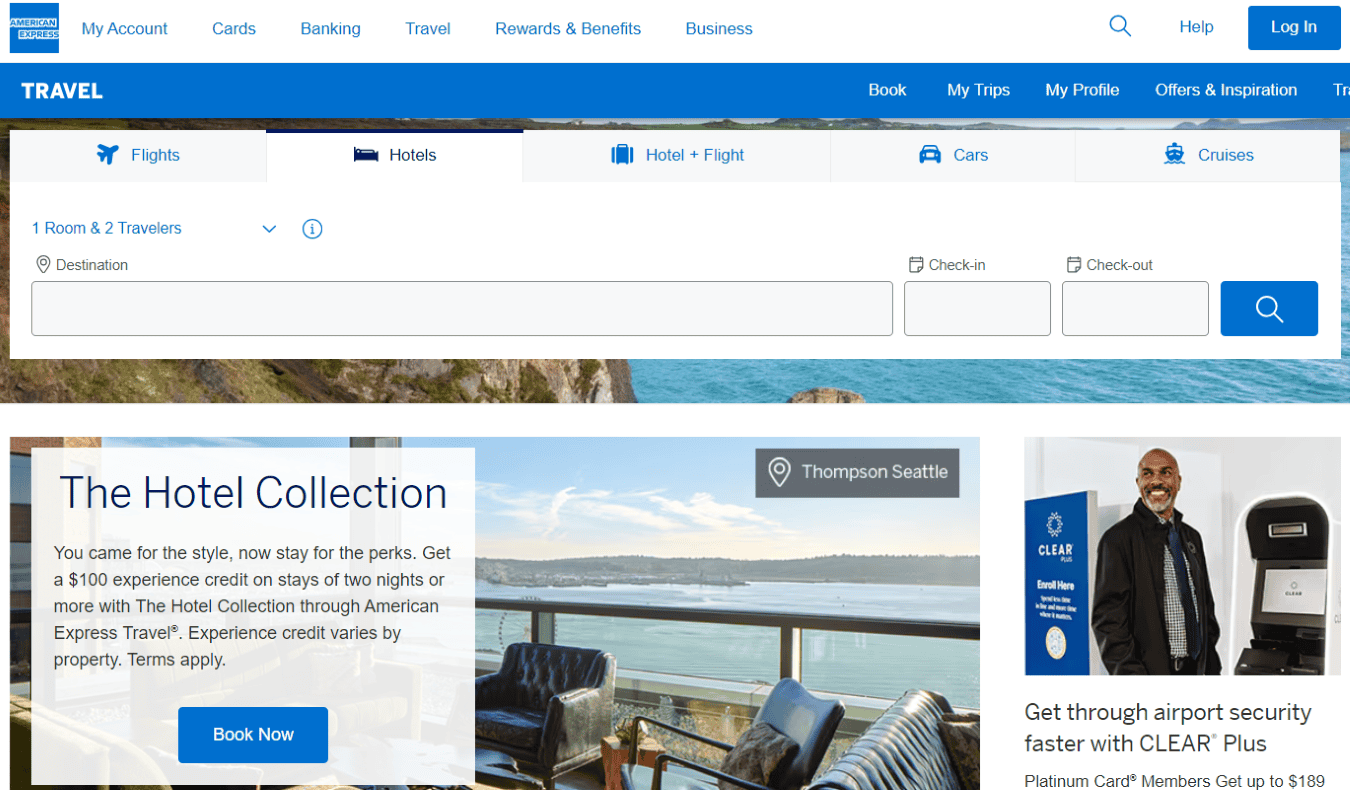

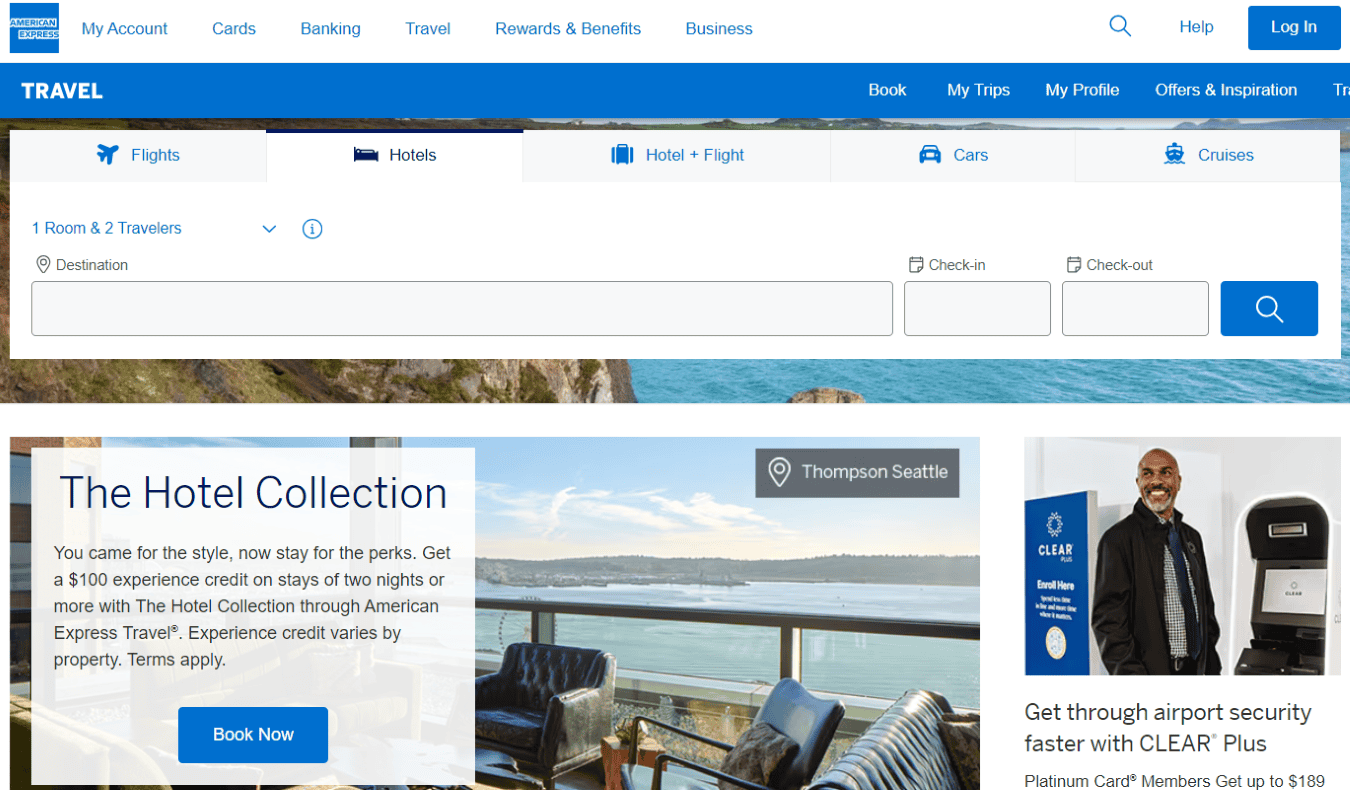

Journey portals are on-line journey companies (OTAs) provided by banks as a part of the advantages of holding considered one of their rewards playing cards. They work precisely like different OTAs, corresponding to Expedia or Kayak, the place you’ll be able to guide flights, motels, and rental vehicles by trying to find availability through their search engine.

The primary distinction is that these journey portals are related to your bank card. This lets you use your factors and miles when reserving. You too can select to pay partially with factors and partially with money.

Utilizing journey portals is mainly like utilizing your factors as money again. You get a set worth per level and additionally, you will earn factors/miles in your reserving.

Bank card firms place their portals as the easiest way to make use of factors. They need you to make use of the portals and keep inside their ecosystem in order that they will earn cash off of you.

To maintain you on their web site, they provide incentives that you could solely get when utilizing their portal. These incentives embrace the next:

- Journey credit – For those who use the portal, many playing cards provide assertion credit to offset your buy. For instance, the card_name provides $50 USD resort credit score when reserving by means of Chase JourneySM, and the card_name provides a $300 USD annual credit score for bookings by means of Capital One Journey.

- Elevated rewards incomes energy – You’ll earn additional factors when utilizing the portal. For instance, the Capital One Enterprise X and the card_name playing cards each provide 10x on motels and rental vehicles and 5x on flights when booked by means of their portals.

- Elevated level worth – You’ll get a small increase within the variety of factors/miles you’ll be able to money in simply by utilizing the portal. For holders of Chase Sapphire playing cards, for instance, 1 level turns into 1.25 or 1.5 factors (with the Chase Sapphire Most well-liked or the Chase Sapphire Reserve, respectively) when reserving by means of the portal. (Whereas that looks as if an awesome deal, you’ll be able to normally get a significantly better worth per level when transferring to journey companions, as I’ll get into under.)

Journey portals are straightforward and handy. Nevertheless, utilizing them is normally not the very best worth in your factors. What you get in simplicity and comfort you lose within the mounted redemption worth that normally isn’t the very best.

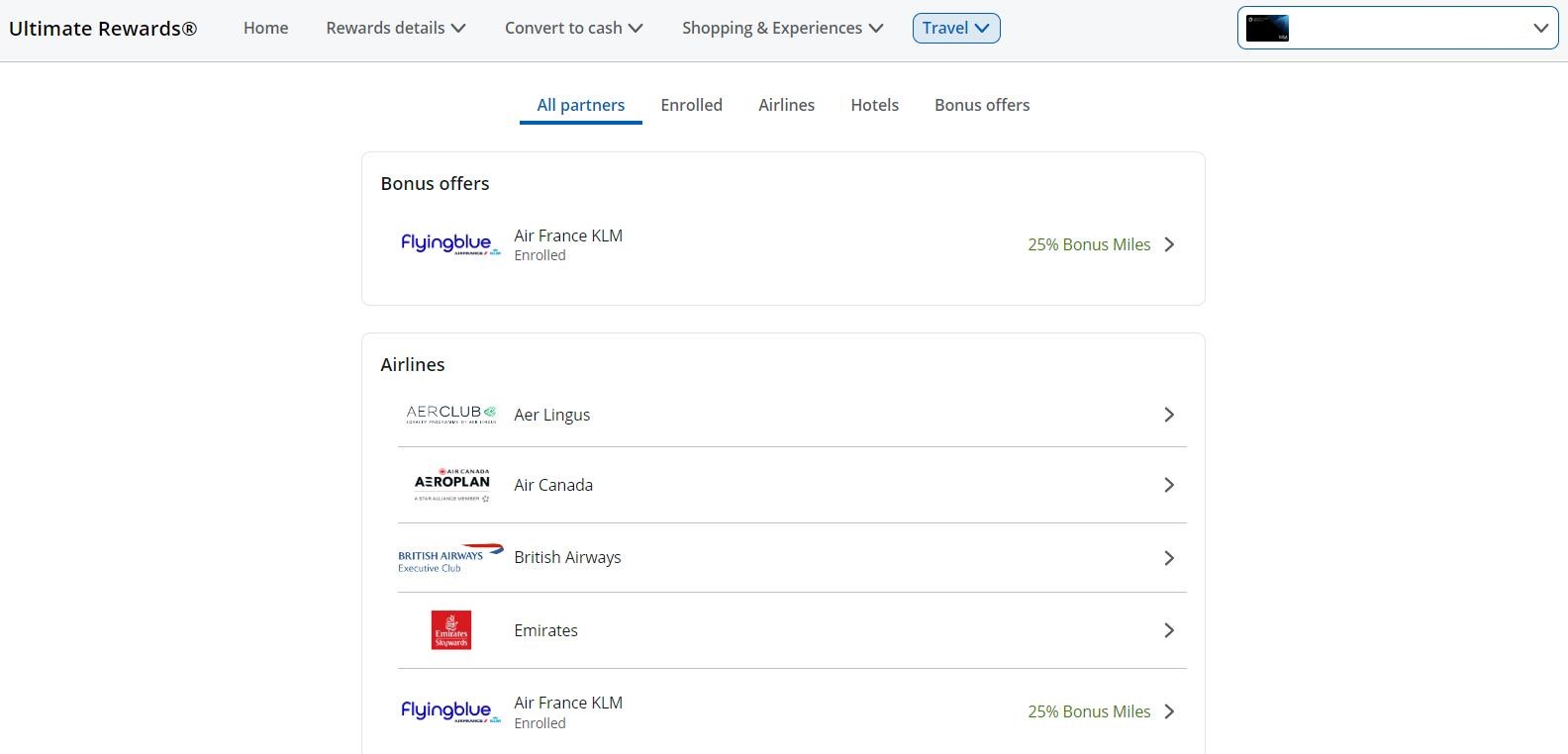

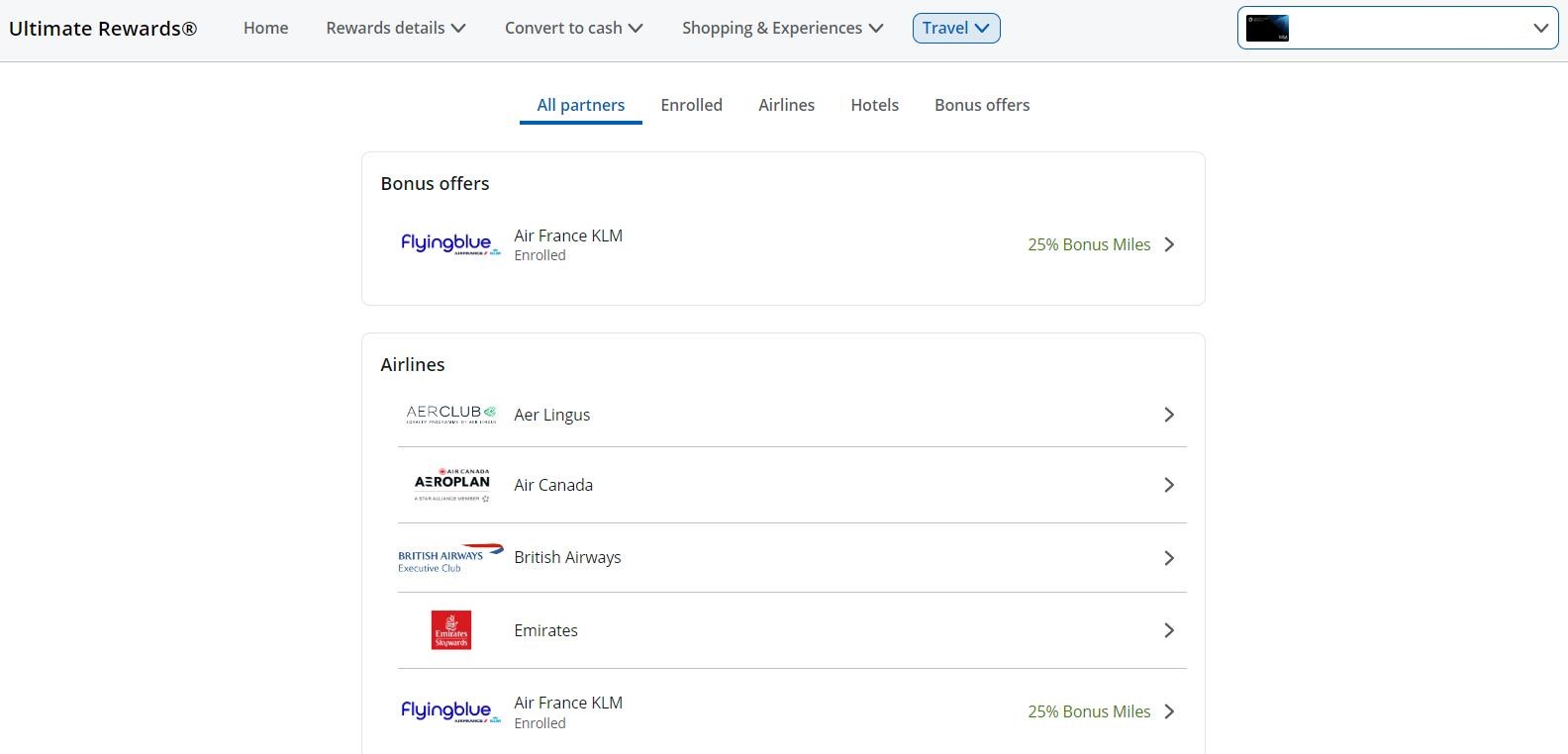

The Low-Down on Switch Companions

On the flip aspect, you’ll be able to switch factors out of your account on to the place the place you need to guide (corresponding to an airline or resort). Whereas transferring your factors to journey companions is a little more work, you may get far more worth out of your hard-earned factors this fashion.

Solely sure playing cards earn you transferable factors although. For instance, airline- and hotel-specific playing cards (such because the card_name or the card_name) solely earn you factors that can be utilized at that airline or resort. They’re much less priceless, as a result of they’re much less versatile. Transferable factors are priceless (and what it’s best to intention to get), as a result of they’re so versatile.

Listed below are a number of kinds of transferable currencies and a few playing cards that earn them:

- American Categorical Membership Rewards: The Platinum Card by American Categorical, the American Categorical Gold Card, the American Categorical Inexperienced Card.

- Chase Final Rewards: the Chase Sapphire Most well-liked® Card, Chase Sapphire Reserve®, Chase Ink Enterprise Most well-liked® Credit score Card.

- Bilt Rewards: Bilt Mastercard®.

- Capital One miles: All Capital One Enterprise playing cards.

- Citi ThankYou Rewards: Citi Premier® Card.

Every transferable foreign money has completely different journey companions (many overlap). Listed below are a few of Chase’s journey companions, listed on the Chase JourneySM web site:

Whereas the precise worth you may get varies enormously primarily based on the flight or resort, a superb benchmark is The Factors Man’s month-to-month valuation chart, which values most transferable currencies at over 2 cents per level when used as transferable factors. That’s double what you’ll get on journey portals, and infrequently you may get far more.

That’s as a result of when transferring your factors, you can even make the most of switch bonuses provided by bank cards and flash offers (corresponding to Air France-KLM Flying Blue promo awards, that are month-to-month offers on award flights). These could be unimaginable offers, as much as a 50% low cost!

Whereas discovering award availability immediately with airways can appear overwhelming, the excellent news is that instruments like Level.me (an award flight search instrument) make it simpler than ever.

Usually talking, I at all times switch my factors. Doing so offers the very best worth and reserving direct ensures that there is no such thing as a third-party concerned ought to there be a difficulty with my flight. Furthermore, it takes loads fewer factors for a redemption this fashion. Let me let you know why within the subsequent part.

Evaluating Companions vs Portals: Which One Is Finest for You?

Except there’s a tremendous low cost flight or room (lower than $150 USD), I at all times switch factors to journey companions, particularly when reserving business-class flights or nicer resort rooms. You simply get extra bang in your buck.

For instance, a enterprise class flight from New York to Paris in peak season is 88,000 factors on United every means (each Chase Final Rewards and Bilt Rewards switch to United). These flights normally price about $2,400 (although they will get as excessive as $5,000). For those who had the Chase Sapphire Most well-liked or Bilt Rewards Card and booked by means of their respective portals, you would wish 192,000 factors (every level is price 1.25 cents in both of those portals). That’s over double what you’d want when transferring your factors to United reserving immediately.

Since most flight redemptions for economic system begin at 20,000 factors (when transferring on to airways), it is advisable discover a flight that’s lower than $250 for it to be price it to make use of the portal. That is when utilizing the Chase Sapphire playing cards or the Bilt card, which give you greater than 1 cent per level when reserving through their portals. For Amex or Capital One playing cards, you solely get 1 cent per level/mile. Which means you’d have to discover a flight for $200 or much less for it to make sense to make use of their portals.

For motels and rental vehicles, it’s rather less black and white since you don’t at all times have switch companions.

For instance, I’m reserving motels through the Chase Journey portal on an upcoming journey to Barcelona as a result of there aren’t any rooms bookable with factors accessible. (You may solely switch factors from bank cards to chains like Hyatt or Marriott.) Since motels are $300 and up per evening, I’m simply utilizing my factors to save lots of me cash by reserving with a non-chain resort. I wouldn’t be capable of guide with factors in any other case. That is the exception to the rule.

Listed below are another circumstances wherein utilizing the portal is the best choice:

- There aren’t any award seats accessible in your desired flight (corresponding to for those who’re flying in peak season or through the holidays) or resort (corresponding to if you wish to guide a boutique resort that’s not bookable with factors).

- You’re reserving a rental automotive and need to use factors (you’ll be able to’t guide rental vehicles immediately through factors).

- You’re chasing airline standing and need to earn factors in your reserving.

- You merely gained’t use your factors in any other case.

About that final merchandise: at all times think about your journey objectives and decide whether or not the benefit and comfort of utilizing the portal is price it to you. Utilizing your factors, no matter how, is best than letting them sit round! By no means stockpile your factors. They get devalued on a regular basis. So use them fairly than lose them!

Journey portals could be an attractive means to make use of your factors. They’re handy, and banks offer you incentives to make use of them. For those who’re new to factors and miles and simply desire a easy technique to money in your earnings, they’re positively an possibility.

Nevertheless, you’ll be able to normally get significantly better worth out of your factors by transferring them on to airways or motels. The less factors you employ per journey, the extra factors you’ve for extra journey (or extra factors to fly/keep in luxurious).

However the great point is that you simply don’t have to decide on both the portal or transferring to companions. You may combine and match relying on the best choice on the time. So do a fast comparability and use factors to guide your subsequent journey!

Ebook Your Journey: Logistical Ideas and Tips

Ebook Your Flight

Discover a low cost flight by utilizing Skyscanner. It’s my favourite search engine as a result of it searches web sites and airways across the globe so that you at all times know no stone is being left unturned.

Ebook Your Lodging

You may guide your hostel with Hostelworld. If you wish to keep someplace apart from a hostel, use Reserving.com because it persistently returns the most affordable charges for guesthouses and motels.

Don’t Neglect Journey Insurance coverage

Journey insurance coverage will defend you towards sickness, harm, theft, and cancellations. It’s complete safety in case something goes fallacious. I by no means go on a visit with out it as I’ve had to make use of it many instances previously. My favourite firms that supply the very best service and worth are:

Wish to Journey for Free?

Journey bank cards assist you to earn factors that may be redeemed totally free flights and lodging — all with none additional spending. Take a look at my information to choosing the right card and my present favorites to get began and see the newest greatest offers.

Want Assist Discovering Actions for Your Journey?

Get Your Information is a large on-line market the place you could find cool strolling excursions, enjoyable excursions, skip-the-line tickets, personal guides, and extra.

Able to Ebook Your Journey?

Take a look at my useful resource web page for the very best firms to make use of if you journey. I record all those I exploit after I journey. They’re the very best at school and you’ll’t go fallacious utilizing them in your journey.

Advertiser Disclosure: “Nomadic Matt has partnered with CardRatings for our protection of bank card merchandise. Some or the entire card provides on this web page are from advertisers and compensation might influence how and the place card merchandise seem on the location. Nomadic Matt and CardRatings might obtain a fee from card issuers.”

Editorial Disclosure: “Opinions, opinions, analyses & suggestions are the writer’s alone, and haven’t been reviewed, endorsed, or authorised by any of those entities. This web page doesn’t embrace all card firms or all accessible card provides.”

For charges and costs of the Marriott Bonvoy Bevy™ American Categorical® Card, See Charges and Charges.

For charges and costs of the Delta SkyMiles(R) Gold American Categorical Card, See Charges and Charges.